Letters from Lodi

An insightful and objective look at viticulture and winemaking from the Lodi

Appellation and the growers and vintners behind these crafts. Told from the

perspective of multi-award winning wine journalist, Randy Caparoso.

The recent 2025 Wine Market Council conference tackles the domestic wine industry's current setbacks head-on

Dr. Liz Thach, MW, President of the Wine Market Council.

This past April 2 at the 2025 Wine Market Council (WMC) Annual Research Conference and Members Meeting, held in the City of Napa, there was some illuminating discussions on the overall state of the American wine industry.

Some of the burning questions that were addressed included:

• What are the core reasons explaining the current lack of enthusiasm for wine on the part of consumers, reflected in the alarming downward trend in consumption over the past two years?

• How can the wine industry rebuild relevance with modern consumers?

• To what extent will impending tariffs further hamper the health of the domestic wine industry?

• What or where are the potential growth opportunities over the next few years?

2025 WMC Annual Research Conference and Members Meeting earlier this month in Napa. Sarah Brown, winebusiness.com.

Dr. Liz Thach, MW, started off the conference with a talk, according to a report filed in newsbreak.com, on the need for the industry to “double down on the moments it already owns, such as food, connection, and romance... rebuilding relevance with modern consumers also requires embracing tech-forward solutions like PairAnything, which simplify wine discovery and enable more inclusive, authentic engagement.”

As Dr. Thach points out: “Economic pressure is also reshaping purchasing habits, leading to steep declines in value wine sales—the entry point for most new wine drinkers. Compounding the issue is a lack of positive messaging around wine, which struggles to remain relevant in dynamic, high-energy social settings.”

As part of her presentation, Dr. Thach shared a few insightful graphs. First, on the “environment” illustrating the dynamic between industry production and actual domestic sales which, interestingly enough, clearly demonstrates steadily increasing revenue despite a downward trend in production in response to recently declining consumption:

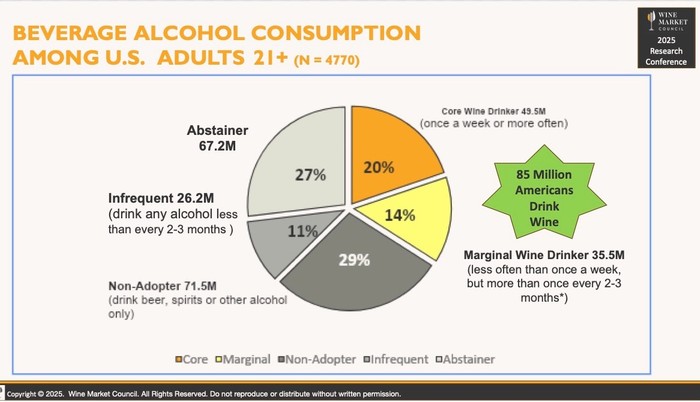

A second slide shown by Dr. Thach is quite positive, revealing the surprisingly large number of Americans—some 85 million of them, or more than a third of the adult population—who currently report that they consume wine, anywhere from once a week to at least once every 2-3 months:

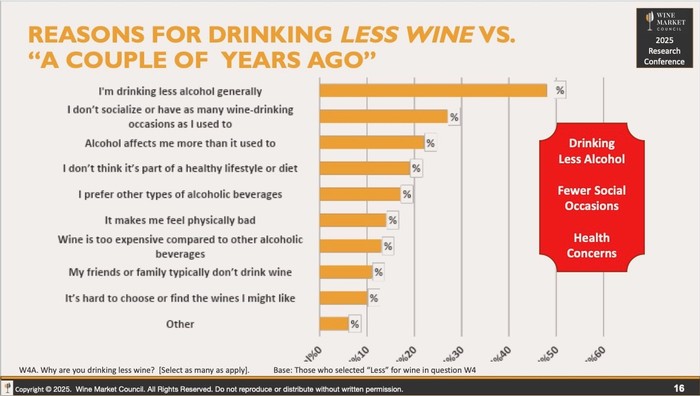

Dr. Thach also shared some latest research which directly tackles the question of why Americans of adult age may be currently foregoing the consumption of wine and other alcoholic beverages just over the past two years:

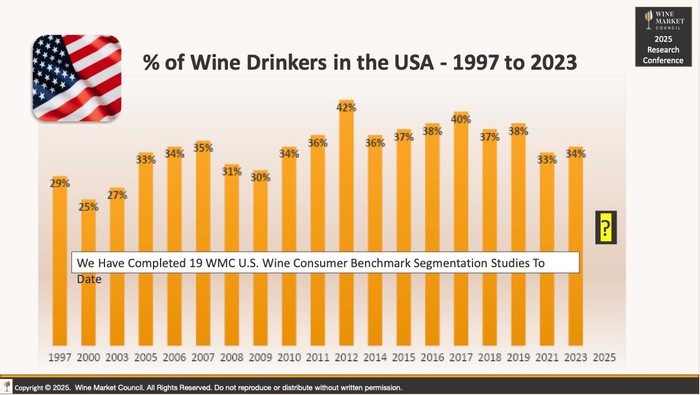

Contrary to many assumptions held even within the industry, wine consumption in the U.S. since the late 1990s has not followed a predictable pattern. As a matter of fact, there have been a surprising amount of ebbs and flows; the bottom line of which, the most recent established percentage (34% in 2023) is roughly on the par with consumption rates recorded in 2006 and 2010, representing a drop from a high of 42% reported in 2012:

In an April 3 winebusiness.com report entitled “Economic Uncertainty, Consumer Perception at the Core of Wine Industry Challenges for 2025,” Sarah Brown wrote, on the 2025 WMC conference:

Last year, many wine industry experts pointed to 2025 as the light at the end of the tunnel, when the destocking period would be over, and wine sales would stabilize or potentially even pick up. Now, a quarter of the way through 2025, speakers at the Wine Market Council’s (WMC) Annual Research Conference and Members Meeting said this year might be just as, if not more, challenging than last year...

[According to WMC President Dr. Liz Thach, MW], ““It seems to be a time of uncertainty and turbulence—anything can happen.”

Much of the industry’s opposition is the same as in 2024: changing consumers, a competitive landscape, anti-alcohol sentiment and inflation with the added anxiety surrounding impending tariffs. While any one of these might be considered a defeatable foe, market analyst Danny Brager said that combined these challenges mount an offense the likes of which the wine industry has never encountered...

Tariffs would inevitably increase prices of many consumer goods, but Brager noted that the average American consumer is already under added economic pressure from multiple years of high inflation. The cost of everyday necessities has increased 33% since 2019 and when faced with the grocery bill, consumers will always put groceries before frivolous purchases like wine.

Danny Brager, Brager Beverage Alcohol Consulting. Jeff Quackenbush, North Bay Business Journal.

Answering, perhaps, questions about why there are contradicting reports of simultaneous downward consumer consumption and steadily increasing revenue, Brown cites Brager's remarks pinpointing the current areas of decreasing and increasing opportunities for sales:

The recent pullback on spending seems to focus on value wines, according to SipSource data, which found that wines priced below $11 suffered double digit declines, resulting in an overall 7% decline in sales volume.

This bodes well for premium brands, but value brands, which Thach called “on ramp” wines for new drinkers, account for 80% of sales volume and 56% of sales value for the wine category. If the sub-$13 category isn’t growing, Brager said, it’s difficult for the rest of the wine category to do well.

Brager reassured the audience that despite these challenges, there are still bright spots and potential for growth in the industry. It’s a matter of getting “more liquid to more lips,” he said.

There are still opportunities for growth in wine-based RTDs, “better for you” brands and nonalcoholic wines. Another avenue for growth is small format bottles (<750 ml), which allow consumers who may live alone or only with a partner to enjoy wine without paying for a full bottle or throwing away leftovers. Half bottles are also doing particularly well in the on-premise, Brager said, where diners may be moderating or enjoying a cocktail in addition to their wine to make the most of their evening.

Even with the newer industry challenges, the issue of connecting with younger, multicultural consumers remains. To provide further inspiration to boost sales and engage consumers, Thach shared some of the key findings from WMC’s 2024 study on younger, multicultural consumers, conducted in partnership with data group Ethnifacts.

Dr. Liz Thach, MW during a recent visit to Lodi wine country.

Finally, Dr. Thach spoke frankly on the most recent challenge of getting younger adults (ages 21 to 34) more interested in wine, or at least at the levels shown by previous generations when they were of the same age. As reported by Brown:

“Overall, young adults do like wine, but they are overwhelmed by many other beverage choices, wine’s complexity and a lack of perceived wine occasions,” Thach said. Wine needs to lean into the moments that it already owns—food, connection and romance—but also increase its presence in more high energy occasions, such as sporting events and music festivals.

At the core of industry concerns, Thach said, is promoting a positive message around wine. “We definitely need to come together as an industry more; for every five negative messages there are about wine online, there’s only one positive.”