Letters from Lodi

An insightful and objective look at viticulture and winemaking from the Lodi

Appellation and the growers and vintners behind these crafts. Told from the

perspective of multi-award winning wine journalist, Randy Caparoso.

Sobering thoughts at the start of 2025⏤The state of the American wine industry

Young wine lovers during a recent Lodi Wine & Chocolate Weekend celebration.

The business of Lodi is grapes. In fact, the region's climate and soils are so ideal for the cultivation of grapevines, Lodi has become the largest winegrowing region in America.

To what extent? According to most recent USDA reports, the Lodi AVA (i.e., Crush District 11) crushes approximately 20.5% of all wine grapes grown in California. To put things in perspective, Napa Valley produces just 4% of California wine (per Capstone California).

There are, of course, wine industries in other states. Still, since 81% of all domestically produced wine is grown in California (re Wine Institute), approximately 17.1% of all American wine is grown in Lodi.

In respect to all wine, both foreign and domestic, consumed in the U.S.: Approximately 65% is domestically produced (re CGA, September 2024). This means some 11% of all wine consumed in America is grown here in Lodi.

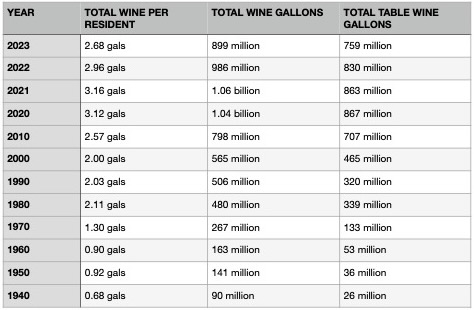

Which is why the issue of wine consumption throughout the entire country is such a big deal to Lodi winegrowers. First, some cold hard numbers put out by the Wine Institute (re U.S. Wine Consumption):

What the entire American wine industry finds alarming is the fact that after 90 years of steady, most times gradual yet always promising growth in all facets, over the past two years individual wine consumption as well as total gallons consumed have sunk down to levels closer to that of 2010. That's over 12 years of positive industry growth wiped out... by what?

Never mind the answer. All anyone living in Lodi needs to do is drive around and see the acres and acres of vineyards that were left unpicked after the 2024 harvest, the grape clusters left shriveling on the vine. It is not just shocking to see. Many of these vineyards will not see their usual winter pruning in preparation for the 2025 vintage. Instead, they will be pulled out.

There are, simply, more grapes out in the fields than are currently needed. Consequently, the Lodi wine grape industry is in the midst of a difficult⏤make that painful⏤process of market correction.

Unwanted, unpicked grapes in Lodi, left to shrivel on the vine in late November.

Is the American wine industry in imminent danger?

Almost inevitably, over the past year many of the headlines posted by media, both print and online, has portrayed the status of the American wine industry in terms of "the end is near." Is it? Or rather, is that even possible? The probability of Americans, or anyone else in the world, failing to appreciate the benefits of wine is probably as likely as people ceasing to enjoy beer, spirits, coffee, tea or soda pop. Not going to happen.

All the same, no one is oblivious to the recent decline in wine consumption. The reason why the American wine industry grew at a rapid pace during the first 150 years of the country's existence is because most of its populace originated in European countries, where wine has been an integral part of the culture for well over a thousand years.

In Europe itself, however, all the statistics have been showing that wine consumption has declined by nearly 25% over the past twenty or so years (re the European Parliament report on The EU Wine Sector). Accordingly, European Union wine countries have been steadily reducing their own plantings of grapes during this same period of time.

No matter what the price point or quality level, wine is still, after all, a commodity. Even winegrowers in Italy, France and Spain⏤in that order, the three largest wine producing countries in the world (followed by the U.S.)⏤do not cultivate vineyards unless there is a specific market niche to be filled and a profit to be made.

Recently uprooted old vines in the Lodi AVA.

Transition rather than demise

In response to increasingly demanding consumer tastes and preferences, Lodi has been undergoing a transition from purely commodity farming to premium winegrowing. The operative term is transition.

Think of music: The tastes of the "Greatest Generation" transitioned from big band to jazz, bossa nova, bebop or pop standards. Blues and gospel went from R&B or doo-wop to Billboard Hot 100 pop, soul, rock 'n roll or hard rock. Hillbilly turned into country-western, bluegrass or pop disguised as country. Many tuned into folk, Cajun-Creole, World, reggae, salsa, you name it. Younger Boomers and Gen Xers dug punk, new wave, rap or hip-hop. Millennials and Xers seem to listen to all of what came before, and have even brought back the vinyl record players most Boomers threw out long ago.

Why should wine be any different? Consumers always want what's new, what's hot, what's different. Today's farmers in Lodi are well aware of the constantly diversifying market. Within their own lifetime, vineyards have transitioned from products destined for the table grape or sweet dessert wine market to the table wine market, which shifted from jug wines and generic wines to varietal wines and proprietary blended wines, from Cabernet Sauvignon, Chardonnay and White Zinfandel to red Zinfandel, Albariño, Tempranillo and, most recently, over a hundred other grape varieties.

Lodi's winery clients are shifting from predominantly giant sized companies producing commercially correct or predictable wines to more and more unpredictable, small, handcraft, artisanal and even natural or "terroir" focused alternative style wines.

Lodi's sustainably, organically and Biodynamically farmed Vino Farms, a giant sized grower that caters to both big wineries and small wineries meeting the growing consumer demand for handcraft artisanal wine.

Farming has gone from conventional winegrowing where health and environmental consciousness are neither here nor there (because these factors didn't used to matter to consumers) to sustainable, organic and even (most recently) regenerative farming practices where the environment and issues such as climate change mean everything⏤to the farmer, to brands and producers, and most importantly, to the consumers who do what consumers always do, which is to continuously make new demands.

Finally, if you think "sense of place"⏤something most wine lovers did not think even existed in California just twenty or thirty years ago⏤is not meaningful, just look at the current global obsession with "old vines" (re The Old Vine Registry or Historic Vineyard Society), epitomized by vineyard-designate wines made from Zinfandel, Cinsaut, Carignan, Mission, and even the occasional Riesling, Chardonnay or Colombard. These wines are valued more than ever because they express special attributes, sensory and intellectual, related precisely to their places of origin. The consumers have awoken to that significance.

Clearly, this is not a market in danger. It's a market in continuous shift, adjustment and evolution, as well it should be.

Positive signs in the marketplace

Yet, as we've made note of in another recent post (While wine consumption in the U.S. slumps, American appreciation of wine grows unabated), in the U.S. actual wine sales have dramatically increased from $80.0 billion in 2020 to $107.4 billion in 2023. That's nothing to sneeze at. Americans may be consuming less wine by volume, but they are clearly spending increasingly more on the wine that they drink.

A sign of different times: Albariño, a grape of Spanish origin that has recently become more popular than even Chardonnay and Sauvignon Blanc in Lodi wineries.

Hence, the positive attitude still felt within much of the American wine industry: For instance, the recent message sent out by one of Lodi's finest (in terms of pure quality) producers Harney Lane Winery, in which co-owner Jorja Lerner described wine, in her public journal, as "The Great Equalizer." Wrote Lerner, to the followers of their Lodi wines:

Part of the joy of wine lies in its remarkable diversity. Glancing at the wine aisle in your local grocery store or wine shop confirms this truth. With over 10,000 wine grape varieties worldwide and more than 100 growing in our region alone, the options seem endless. When you consider the various blends, vineyards, vintages, and countless factors that contribute to unique outcomes, it becomes clear that the 4,800 wineries in California alone likely offer over 60,000 distinct interpretations and expressions of wine grapes at any given time.

Even at our small estate winery, we produce wines from eight different varietals, which are used to create over 12 selections in any vintage. After 19 years in the business, we’ve crafted nearly 200 unique wines, each influenced by barrel selections and the specific weather conditions of the vintage.

Harney Lane Winery co-owner Jorja Lerner. Harney Lane Winery.

I would argue that wine offers more variety to explore than any other product I can think of. This diversity is part of the joy of wine, also reflecting the wide range of tastes we, as consumers, possess. As [husband/partner] Kyle often jokes, you don’t go “milk tasting.” While this is partly due to the beautiful settings of wineries, it also underscores how wine invites curiosity and exploration and offers a multitude of options. Everyone’s palate is different, and what appeals to one person may not resonate with another. Wine celebrates these differences, inviting us to savor and appreciate them.

Harney Lane's production, of course, is peanuts compared to that of the Sonoma County based Jackson Family Wines, consisting of over 40 brands churning out over 6 million cases of wine per year. In a recent (June 2024) SevenFiftyDaily article posted by Tina Caputo, Jackson Family's director of research and consumer insights Karen Daenen was quoted to say:

Looking at off-premise dollars [i.e., retail sales], domestic table wines are up 56 percent since 2018... similarly, on-premise [i.e., primarily restaurant] dollar sales have increased 65 percent between 2018 and 2023...

Added Shilah Salmon, Jackson Family's senior VP of marketing, "The only places that we have seen downturns are where we have raised prices, but we're seeing positive turns now where we had forecasted."

Scenes from the 2024 Lodi Wine & Chocolate Weekend.

So what gives with the rosy picture drawn by tiny and big producers alike, in direct defiance of all the "headwinds in the wine industry," as Daenen put it? It is mostly because the recent decline in wine consumption is still seen as correctible setback. In its State of the U.S. Wine Industry 2024 Report, Silicon Valley Bank laid the dip in volume sales mostly at the feet of younger consumers roughly under the age of 35⏤specifically Generation Z (born between 1997 and 2012) and Millennial (born between 1981 and 1996) consumers.

Baby Boomers (the youngest of whom are now in their early 60s) are still considered the industry's "good guys" because, according to Silicon Valley Bank, 58% of them still prefer wine above all alcoholic beverages. Research has been showing that this preference drops nearly 30 points for each of the other demographics (Gen X followed by Millennials and Zs).

Jackson Family's Daenen, however, has pointed out more positive data. She cites a Numerator survey of wine shoppers ending in December 2023 that show "that younger generations spend more per bottle... together Gen X, Millennials and Gen Z account for 59 percent of sales at $20-plus price points." Even as the overall market declines, there are more than enough opportunities for growth.

All eyes, though, will continue to remain on emerging Gen Z and younger Millennial consumers. When will they ever begin to hold up their end? If not, what is it about wine that has led to disinterest among many younger consumers⏤adding to the overall decline in consumption that has been resulted in such savage impact on the American wine industry in general, and on the Lodi wine grape industry in particular? This, we will discuss in our next post.

Tasting room at Lodi's Michael David Winery,